Individually

Managed Accounts (Kuala Lumpur)

Our company's philosophy can be summed up as Independence,

Intelligence and Integrity.

Anchored on the values of these 3 'i's, CDAM has gradually and

successfully built up its recognition and reputation in the

investment industry, locally and regionally. The persistent

application of the 3 'i's philosophy holds the key to Capital

Dynamics’ consistent investing success.

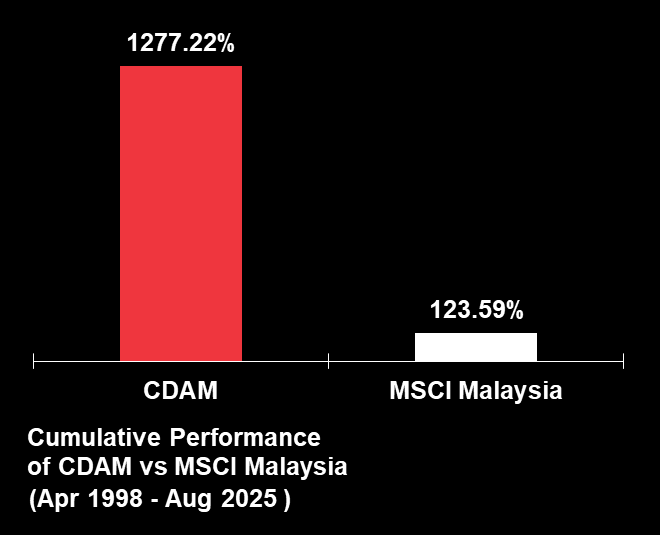

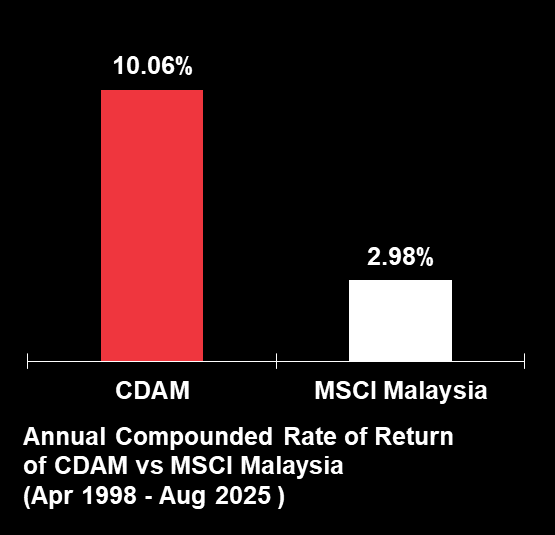

Good intentions must be tested against actual performance.

CDAM has consistently outperformed the MSCI Malaysia since its inception

From 1997 to 2025, CDAM has only recorded seven years of negative return in 2008, 2013, 2014, 2015, 2018, 2022 and 2025.

From 27 April 1998 to 31 December 2025, CDAM achieved an impressive compound return of 10.09% per annum versus a return of 3.16% for the MSCI Malaysia.

During bull markets, all fund managers can perform well. The

difference between a good fund manager and a lousy fund manager can

only be seen during bear markets. As we all know, you will only know

who is swimming naked when the tide goes out as the figure above

shows.

If an investor opened an account worth RM100,000 with CDAM in April 1998, by December 2025,

the investment would have grown to RM1,432,543. But if the investor had invested RM100,000

in MSCI Malaysia, the investment would have only grown to RM237,036.

Even if the investor invested with CDAM during the peak of the market in early 2000, the returns would be slightly more than 5.5 times after 25 years. If someone invested in MSCI Malaysia at the said peak, the investment would only be close to 1.5 times.

- NEW IN ICAP

- Sed nec urna sed leo luctus fringilla.

- Aenean a ipsum ut ligula scelerisque consectetur eget et risus.

- Suspendisse egestas mattis sagittis.

- Donec vel nisl non quam eleifend rhoncus.

- ICAP F.A.Q.

- In venenatis mi quis tellus bibendum pharetra dapibus odio accumsan?

- Aenean a ipsum ut ligula scelerisque consectetur eget et risus?

- Suspendisse egestas mattis sagittis?

- Donec vel nisl non quam eleifend rhoncus?

- ASK US ABOUT ICAP